Investing in property in Perth offers a multitude of benefits, making it an attractive option for both seasoned investors and those looking to enter the market. With its high returns and long-term growth potential, Perth has become a hotspot for property investment. In a recent Insight, we provided a high level look at why Perth is worthy of property investors attention. The three prominent factors contributing to this view included:

- its strong economy;

- a booming population;

- a diverse range of industries; and

- strong property demand (and participant demand for NDIS properties).

In this Insight we pull out the magifying glass to look why the Perth property market continues to outperform many markets across Australia.

Understanding the Potential of Perth Property Investment

Perth is currently the second cheapest capital city to buy property in Australia, resulting in a housing market that is constantly under consideration by property investors across the country. Affordable stock, incredibly low vacancy rates and a stable economy are all factors that have made the Western Australian property market an attractive proposition in recent times.

| Location | Median House Price |

|---|---|

| Sydney | $1,070,000 |

| ACT | $848,000 |

| Melbourne | $815,000 |

| Brisbane | $773,000 |

| Adelaide | $697,000 |

| Hobart | $673,000 |

| Perth | $604,000 |

| Darwin | $493,000 |

Proptrack Median Housing Price – November 2023

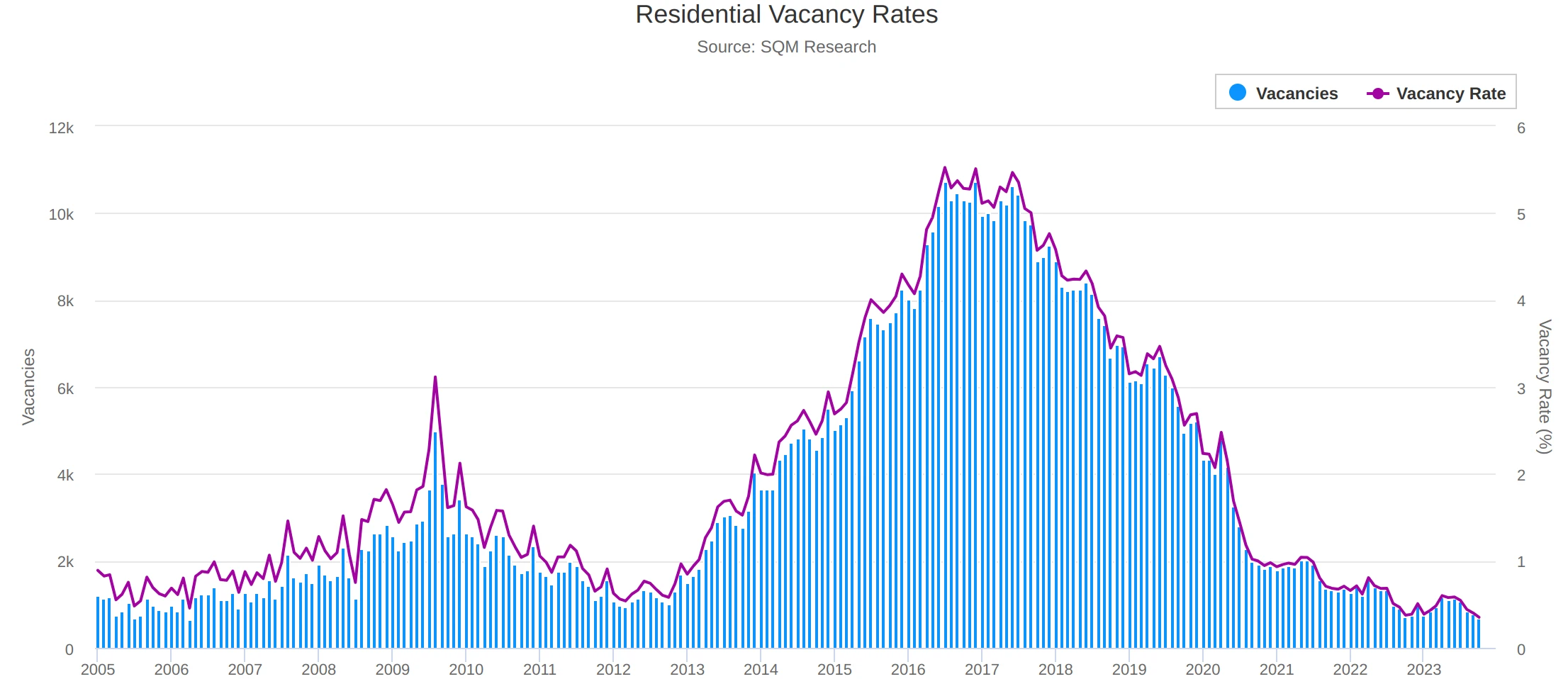

Additionally, the Perth current vacancy rate is a factor worthy of focus. In the Perth metro region it hit an astonishingly low of 0.4% in October, and is the lowest recorded value in history (or since 1980 when REIWA began keeping these records). What does this mean? A balanced rental market averages between 2% and 3%, A value this low means a higher demand, and therefore competition, for quality rental properties.

And this is unlikely to change any time soon. With the slowdown in construction since 2020 – mainly due to supply chain issues and increases in construction costs – an increase in new stock coming to market to relieve vacancy rates could be some time away. Adding fuel to the fire is an increase in net migration figures throughout the year and an influx of new residents looking for homes. Indeed, Perth is seeing a severe shortage of available property relative to demand.

All these factors further contribute to stable tenant demand and in many cases, high rental yields.

An expanding city – Key Infrastructure Investment Projects to watch

METRONET

METRONET is the single largest investment in public transport that Perth has seen, with a vision of a well-connected Perth with more transport, housing and employment choices. With approximately 72 kilometres of new passenger rail and 22 new stations, METRONET is a catalyst to turn more than 8,000 hectares of land around new stations into desirable places to live, work and play.

METRONET is the government’s plan to connect Perth’s suburbs, reduce road congestion and meet Perth’s future planning needs. $1.34 billion has been projected to deliver a number of Metronet priority projects.

ROAD NETWORK

The expanding metropolitan area and growing population have put pressure on existing road infrastructure, prompting new projects to assist with traffic flow. Future developments include:

- NorthLink WA: the $1.02 billion projects will link to Gateway WA, servicing regional traffic movements to commercial and industrial areas such as Malaga, Kewdale, Perth Airport and the Perth CBD.

- Mitchell Freeway extension: lengthening the freeway to Clarkson with the provision for future expansion to Yanchep

- Kwinana Freeway widening: additional lanes are being added at critical merge points

- Perth-Darwin Highway: a 20 to 30-year project with early stages constructing new roads in the Ellenbrook and Bullsbrook areas

CITY REVITALISATION

A number of projects are progressing in Perth CBD that will see more employment opportunities, residential facilities and an enhanced vibrancy in the state’s capital. Projects currently underway include:

- Perth City Link: Multiple developments totalling $5 billion to connect the CBD with Northbridge

- Elizabeth Quay: Will attract over $2 billion in investment and create 10,000 new jobs

- Perth Stadium: A new $1.2 billion stadium and train station opened in January 2018

- Riverside: $880 million project with 6,000 new jobs

- New Museum: $428 million redevelopment has recently opened

$7 BILLION HEALTH PROGRAM

As part of the State Government’s $7 billion hospital building and refurbishment program, three new state-of-the-art public hospitals have replaced existing amenities. A selection of retained hospitals have received upgraded facilities to better serve the WA population.

- Fiona Stanley: $2 billion

- St John of God: $360 million

- Perth Children’s Hospital: $1.2 billion

What could a investment property in Perth look like?

We’ve selected the sample property below as a guide to what can be expected with a traditional property investment in the Southern Perth Development corridor. Florida Beach is a small suburb close to Dawesville, approximately 20km south of Mandurah.

Property Profile

| Component | Value |

|---|---|

| House Price | $403,500 |

| Land Price | $185,000 |

| House & Land Package | $588,500 |

| Deposit | $2,000 |

| Block Size | 450sqm |

| Potential Rent | $570-$620 p/w |

| Estimated Yield | 5.0-5.5% |

Suburb Profile – Dawesville

Median House Price: $571,000 (4 bedroom)

Median Rent: $575 p/w

Vacancy Rate: 0.4%

Florida Beach Estate:

- Masterplanned community;

- 650m from the beach;

- Ocean Road Primary School and the well-regarded St Damien’s Catholic Primary School are situated within the estate;

- Halls Head Secondary College is a 10-minute drive away and a future secondary school will be within walking distance of the estate;

- $19.3M Florida Beach Shopping Centre. The shopping centre is based around a Coles

- supermarket and features a child care centre;

- 10 minutes from the beaches, marina, foreshore, shops and restaurants of Mandurah;

- There are only two land estates in Dawesville, with the rest of the suburb either already

- developed or taking the form of the The Cut golf course. The older Melrose Beach estate has less than 70 lots remaining, while Florida Beach has approximately 200 lots remaining.

Employment Hubs:

- South Metro: Armadale, Maddington, Rockingham, Kwinana, Bibra Lake, Cockburn, Latitude 32, Western Trade Coast, Nambeelup

Current Jobs: 144,000+

Project Jobs by 2050: 437,000+

Demographics:

Wrapping Up

If you are interested in talking to a PPA specialist about your individual circumstances and whether investing in the Perth real estate market is the right fit for you, please contact us to schedule an obligation free discussion. We are eagerly looking for investors to meet demand.